Cost Sharing Policy

Definition of cost sharing

To accomplish the goals or objectives of a research project, Wayne State University will incur costs that may be covered by using funds that the sponsor has provided, by using University resources or by using resources from individuals or agencies outside of WSU and the sponsoring agency. All allowable costs incurred in the performance of a project, and all contributions made by WSU or by the third parties to accomplish the goals of the project are called project costs. Cost sharing and matching represent that portion of the project costs not paid for by the sponsor’s funds. The federal government makes no distinction between the terms “cost sharing” and “matching.” However, in general, SPA uses the term cost sharing when describing a university commitment of any size and uses matching to describe a cost sharing commitment of a dollar-for-dollar contribution.

Types of cost sharing

Cost sharing can take the form of either cash contributions or in-kind contributions. Cash contributions are made when WSU spends non-sponsored project cash in support of a sponsored project. In-kind contributions consist of the value of non-cash contributions provided by WSU or by non-Federal third parties, such as facilities or equipment use, personnel assigned from any private or non-sponsored source, indirect cost, or the value of goods and services directly benefiting and specifically identifiable with the project.

Mandatory and voluntary committed cost sharing

Mandatory cost sharing is required by the sponsor in the proposal solicitation or in award negotiation as a condition of eligibility for receipt of the award.

Cost sharing is voluntary if it is committed by the PI in the proposal when no mandatory cost sharing requirement is included in the proposal solicitation, or if it is more than mandatory cost sharing requirements. Whether cost sharing is required by the sponsor or is offered by the PI voluntarily in the proposal, once the award is accepted, all cost sharing becomes a commitment under the terms of the award, which must be fulfilled and documented. Both are forms of committed cost sharing (mandatory committed and voluntary committed). Uniform Guidance provisions require that faculty document, in the payroll accounting system, all compensated effort, including effort provided as mandatory or voluntary committed cost sharing. Voluntary committed cost sharing is strongly discouraged.

OMB defines voluntary uncommitted cost sharing effort as "university faculty (including senior researchers) effort that is over and above that which is committed and budgeted for a sponsored agreement." This effort "is faculty-donated additional time above that agreed to as part of the award." OMB has excluded voluntary uncommitted cost sharing effort from payroll accounting and reporting requirements. It is not considered part of the effort for which faculty are compensated by WSU. Therefore, there is no associated WSU cost. Also, it is not required to be reported on the effort reports.

Documentation and valuation requirements for cost sharing

In general, cost sharing should be valued according to the allowability principles of the Uniform Guidance and/or the award terms. Under-recovery of allowable indirect costs may be included in cost sharing only with the written prior approval of the federal awarding agency. The basis for determining the valuation of cost sharing MUST be documented.

The most common way of meeting cost-sharing requirements is in the contribution of academic year time and effort, usually of the Principal Investigator or co-Principal Investigators. It is important that the Principal Investigator realize that if he/she intends to meet cost-sharing requirements in the form of academic year time and effort, this option may only be utilized if it conforms with the college's current faculty workload policy. When cost-sharing is met by contributing time and effort, the University may, with written agency authorization, claim as cost-sharing the indirect costs that it would have collected had that time and effort been charged as a direct cost to the grant. Utilize these instructions: Effort Reporting Instructions, navigate to Academica > Administrative Systems > Effort Certification.

Cost sharing of operating expenses requires "hard dollar" cost sharing, usually in terms of charges to the cost sharing fund for research supplies, equipment purchases or services in connection with award activities.

Documentation of outside services and/or consultants must include an invoice that shows the dates of service, rate of pay, description of services, and names of individuals that did work. Rates must be current, verifiable amounts that that firm or individual charges to paying customers. If an employer other than WSU furnishes the services of an employee, the employee’s regular rate of pay must be used to value the services.

Rates for volunteer services must be consistent with those paid for similar work at WSU or with those paid in the normal labor market. Volunteer services may be counted as cost sharing or matching only if the service is an integral and necessary part of the project.

The value of donated supplies (expendable equipment, office supplies, lab supplies, or workshop and classroom supplies) must be reasonable and must not exceed the fair market value of the property at the time of the donation.

Donated equipment must be valued at the fair market value of equipment of the same age and condition. If equipment or computers are being contributed, either as 100% up front donation or a lease equivalent, values used must be backed up with quotes from a vendor who sells like models. The value of loaned equipment cannot exceed its fair rental value.

NIH Salary Cap

The National Institutes of Health (NIH) salary cap is a statutory limitation imposed by Congress on an individual’s rate of pay directly chargeable to grants, cooperative agreements, and contracts issued by NIH. The salary cap limits the rate of pay chargeable to NIH awards to a maximum that is tied to the Federal Executive Pay Scale and the year of the award. The capped rates of pay apply equally to academic year and twelve-month employees.

If an investigator’s salary is over the salary cap, the overage is considered an institutional commitment (cost share), and a non-federal funding source for this overage will need to be identified and reported on a cost-sharing form prior to proposal submission. Principal investigators (PIs) and their department administrators should work with their SPA Grant & Contract Officer to accurately account for salary when the PI’s salary exceeds the cap.

How is the NIH salary cap calculated?

The cap is not on the number of dollars that can be charged to an NIH grant. Rather, the cap is on the monthly pay rate that can be charged to an NIH grant. When an investigator’s pay rate exceeds the salary cap, the cap is applied proportionally to any level of effort the investigator charges to the grant. See example calculations below:

The 2024 NIH salary cap is $221,900/12 months ($18,492/month). This means that if you were to commit 100% effort during a given month to an NIH grant, the maximum amount of salary that could be charged to the grant is $18,492. This maximum decreases proportionally with decreasing effort levels.

To determine the percentage of salary that can be charged to NIH, multiply the % effort by the monthly max. For example, if you were to commit 25% effort during a given month to an NIH grant, the maximum amount of salary that could be charged to the grant is:

Maximum capped monthly salary x Effort Committed to Project = Maximum monthly salary paid by NIH

$18,492 x 25% = $4,622.92

12 Month Appointment Type Example:

2024 NIH Salary Cap: $221,900

PI Institutional Base Salary: $300,000

Effort: 10% = 12 x .10 = 1.20 person months

Calculation: $221,900/12 = $18,492 - 1.20 person months capped salary

$300,000/12 = $25,000 - 1.20 person months PI’s actual salary

Cost Share:

$25,000 – $18,492 = $6,508 - is the cost share amount = 35% charged to the cost share fund

Cost Share Committed by the Office of the Vice President for Research (OVPR)

Cost-sharing commitments by the OVPR must be provided at the time of proposal submission. The OVPR Cost Share Template must be provided and uploaded into the Cayuse proposal record.

- The Office of the Vice President for Research will consider requests for institutional financial support for proposals with a mandatory cost sharing requirement.

- Requests for voluntary cost sharing support will not be considered.

- The following guidelines will be applied in evaluating cost sharing applications:

- Cost share from other units or investigators - school/college/center/institute, department, faculty member(s)'

- OVPR prioritizes contributing cost share when at least 2 other units are contributing and are providing at least 2/3 of the total cost

- Proposals that are aligned with institutional strategies, priorities, and goals.

- Proposals that support interdisciplinary, cross-unit research from more than one school/college, center/institute, or department.

- Proposals that will provide research equipment or facility renovation and will benefit multiple investigators from multiple schools/colleges.

- Proposals that may advance institutional prestige will be considered.

- Proposals from a single school will be considered only when it is part of a larger strategic initiative or has the potential to enhance institutional reputation or status.

- The ability for the school/college, center/institute, and/or department to self-fund in support of the research.

- When reaching a decision, OVPR will consider whether the cost sharing is required by the sponsor, the unit’s contribution, as well as the unit and institutional priorities.

- Requests must be received no later than four weeks before the submission deadline unless the sponsor has provided less time between its solicitation and the deadline. Late requests will be given lower priority. Requests received less than one week before the sponsor deadline will not be considered.

- Commitments from the PI's department and/or college should be obtained in writing before making a request to the OVPR.

Guidance for obtaining OVPR approval

Procedure

The department must document all cost sharing contributions, including third party in-kind contributions, and must provide this information to Sponsored Program Administration in a timely fashion so that SPA may include the information in the financial reports or invoices that they must submit to the sponsor. To adequately report cost sharing expenditures, each department or center must follow these steps:

- A “Cost Sharing” account in Banner will be created for each sponsored project, and records of expenditures that support the cost sharing must be kept in this file. Such records may include timesheets, purchase requisitions, consultant contracts, etc.

- SPA processes funding of cost sharing accounts semi-annually.

- Immediately after the sponsored project expires, a final review and reconciliation of the cost sharing expenses must be done. A final copy of the spreadsheet (and copies of supporting documents, if requested) must be provided to Sponsored Program Administration.

- All the cost sharing documents must be retained for a minimum of three years after the end of the project unless the Notice of Award specifies a longer retention period.

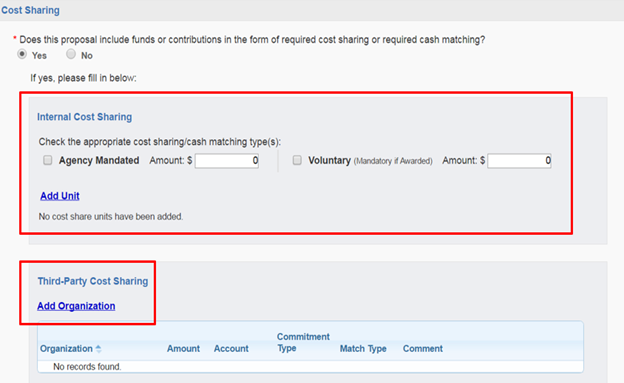

If there is cost-sharing on a proposal budget, the Department must provide SPA pertinent information including funding source, type of cost-sharing, and funding unit or third-party organization. Information must be provided at the time of Cayuse proposal record establishment. If no funding source is provided at the time of proposal submission, the source will default to the department general fund.

Additionally, the Cost-Sharing Commitment Form must be uploaded to the Cayuse proposal record and should accurately reflect the funding source associated with the cost share. These forms must be completed and uploaded into Cayuse at the time of proposal submission so that the applicable information is readily available at the time of award establishment. Again, if a source account index is not provided, the department general fund index will be entered as the source account.

Resource

SRA LevelUp – Principles of Pre-Award Research Administration: Define Cost Share Principles